Leading Australian Bank.

Future digital sales experience.

Consumers are doing more and more on digital expecting XYZ Bank* to stay on top of their game. Business has huge ambitions regarding their digital sales experience as well. They defined a need to engage a 3rd party partner to conceptualise their vision.

*Any associations to the name or the brand of the client were removed for the purpose of this case study.

Teams within organisation work in silos lacking visibility and transparency. Digital Sales Team needs to define and consolidate their future vision and find the best solution to communicate it to the other teams in order to gain internal alignment.

Animated presentation outlining customers expectations, business ambitions, and including a prototype of the future vision and next steps. The deck is presented by a team lead to other teams.

Improve bank’s overall NPS (Net Promoter Score) and increase in percentage of digitally active customers rising from 51% to 80%.

Gain insights and promote transparency through constant communication with internal teams; develop a prototype and visual language of the presentation; team up with Creative Director and the client to consolidate the vision.

The key objective of the discovery phase was to learn about customers, business, and communicate with the internal teams. Meetings with stakeholders, team leads, and design and innovation teams played important role in gaining alignment throughout the project and helped me formulate initial assumptions.

At this stage we decided that the final deliverable will be a recommendation deck including an embedded prototype that addresses key opportunities, like:

Banking has such a complex business offering with many different products and services that have to cater for business and individuals in every stage of life. In order to create clear and simple vision we had to focus on one journey that appropriately addresses customer and business pain points. We also wanted to tackle an experience that can create the most impact from the digital sales perspective, be aspirational and relate directly to the future roadmap.

Having this in mind, we decided to envision a home loan journey for the first home buyers. It’s a complex and extremely stressful experience at the moment, so there’s a huge opportunity to make significant improvements and create impact. Additionally, it involves all omni-channels giving us a chance to make the prototype even more relevant.

First three parts of the deck aim to define the role of digital in sales, identify customer expectations based on their feedback and define business capabilities. These insights lead to next section that presents a future vision including a first home buyers’s experience in a form of a prototype. Lastly, a future roadmap and next steps are explained. Let’s have a look at each of them in more details.

Most customers follow a consistent process when buying a product spending most of the time exploring and considering it. Bank’s website is the starting point for customers when researching and evaluating solutions, but it’s not the only one. Customers will engage on their own terms regardless on a channel. That’s why there’s a need to unify entire digital sales experience.

Based on the customer’s feedback, we defined key themes for future improvements:

Some of the capabilities that the team is working on:

The prototype was built as an animated end-to-end journey through different channels. I will only present selected sections that play key role in the overall experience.

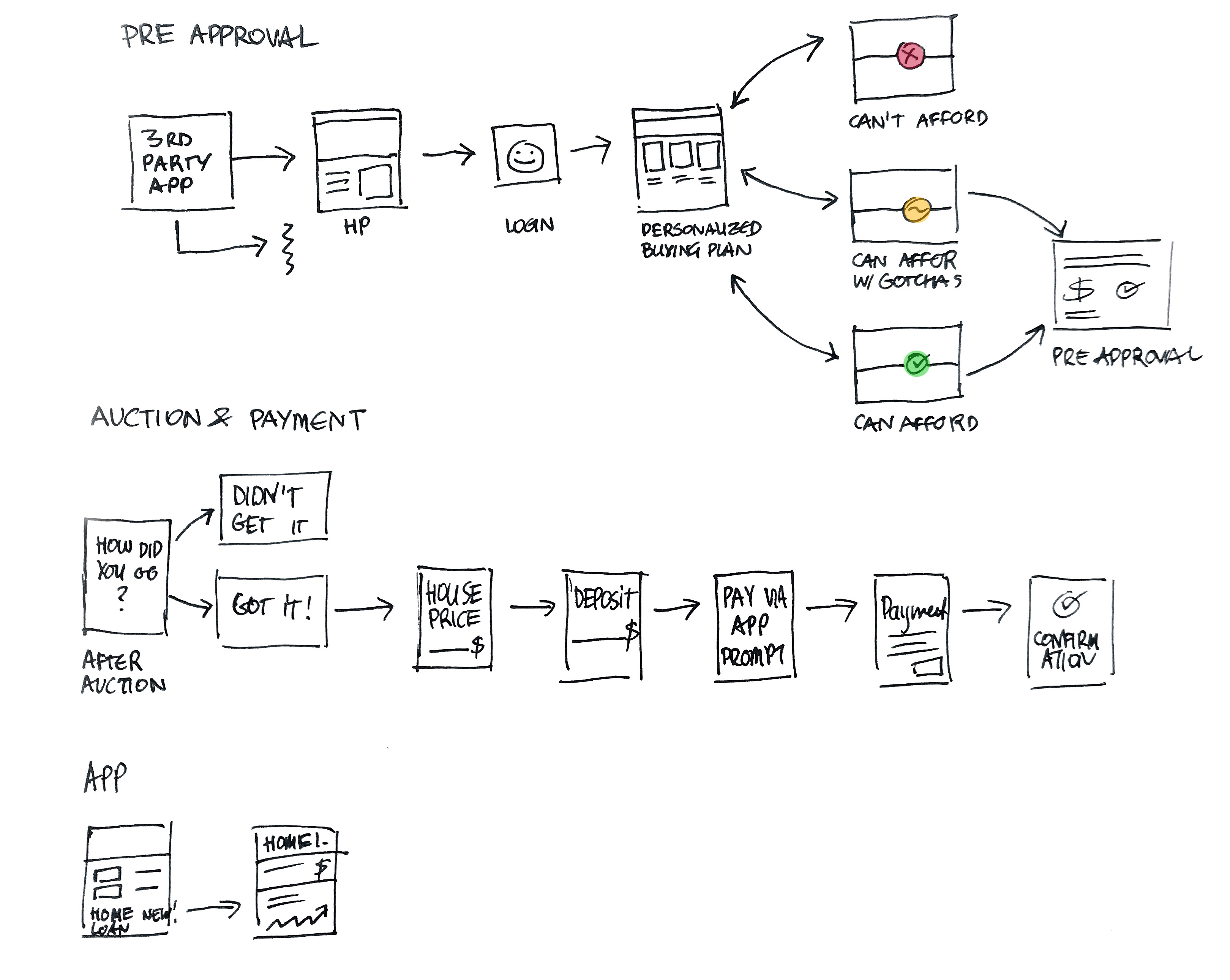

High level flow through the experience on different channels.

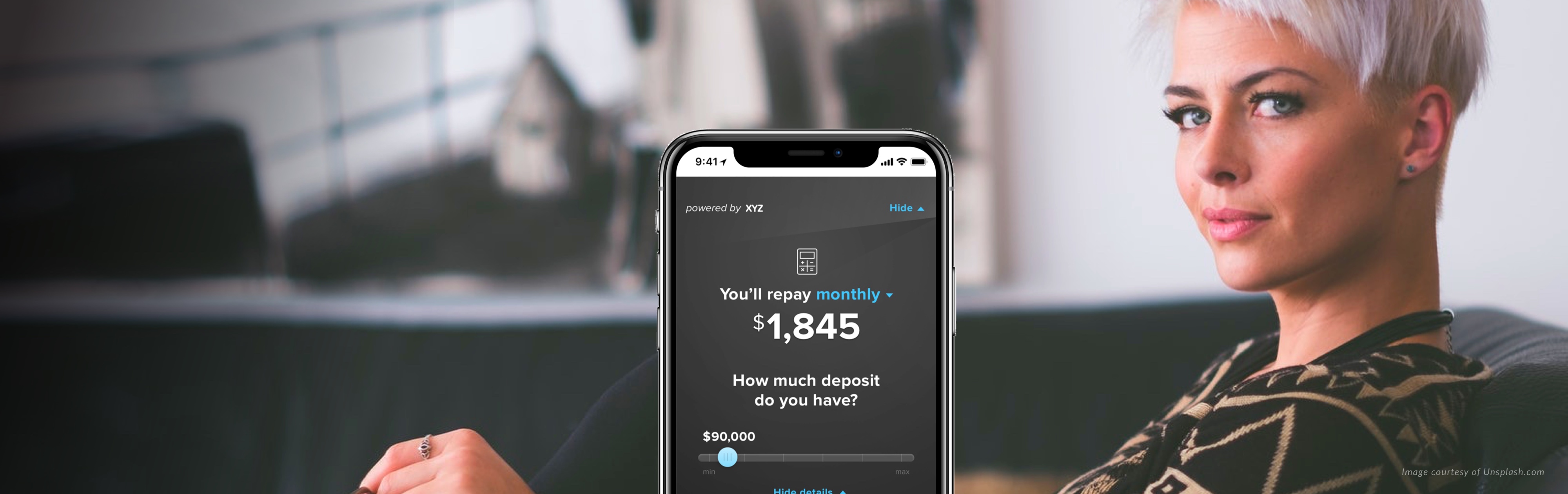

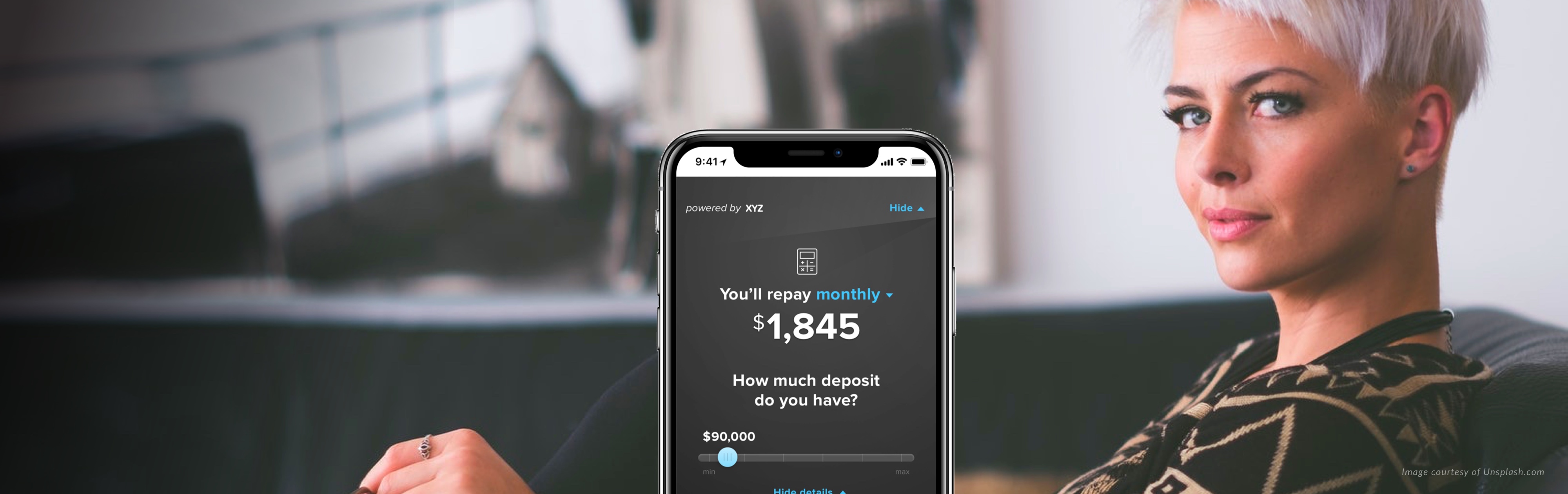

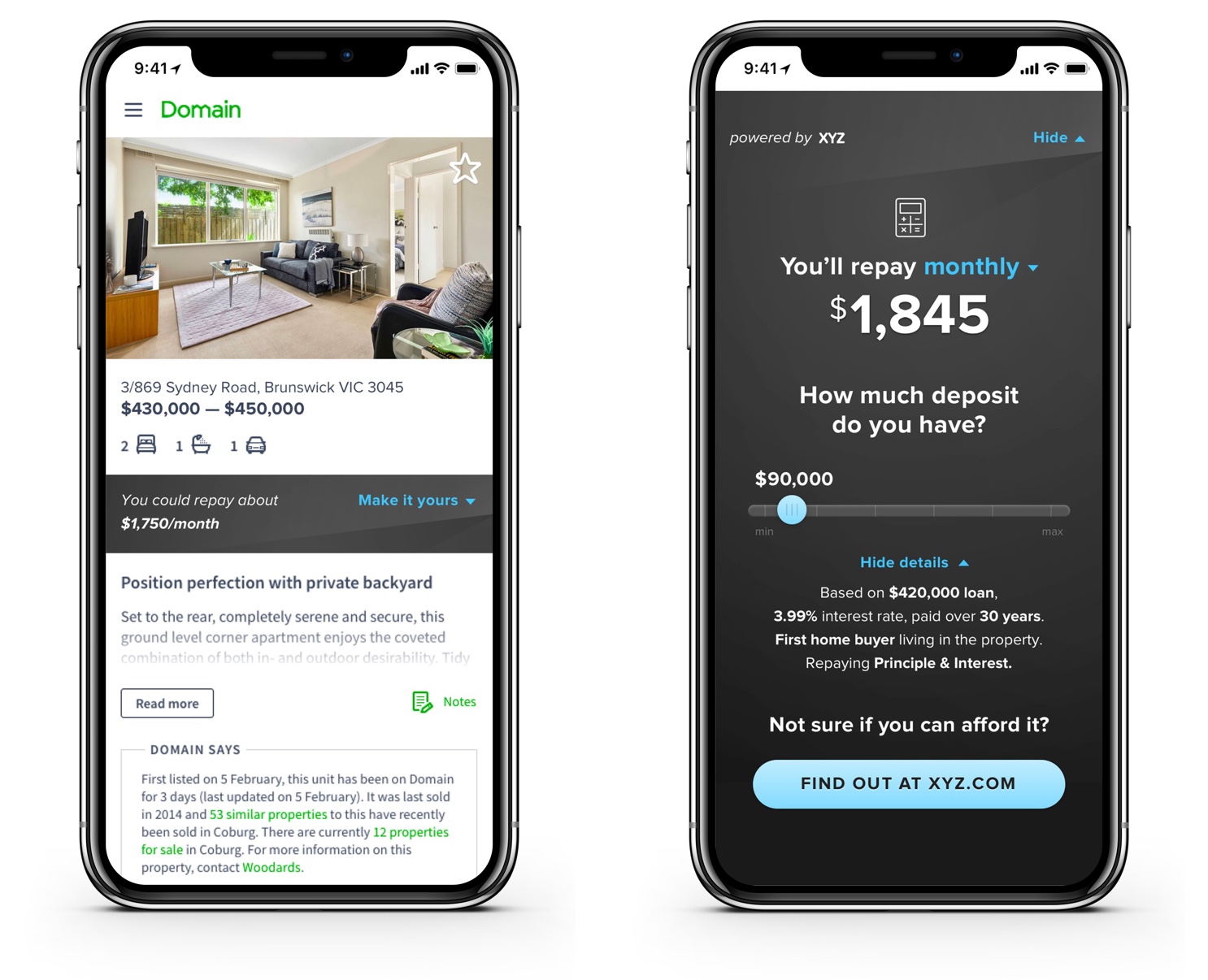

As I learned during discovery phase, customers spend significant time discovering and considering different products using a range of channels. That’s why as a starting point I introduced an idea of an integration with 3rd party apps. Bank’s widget will present more accurate repayments, remember favourited options, and provide next steps.

Third party integration.

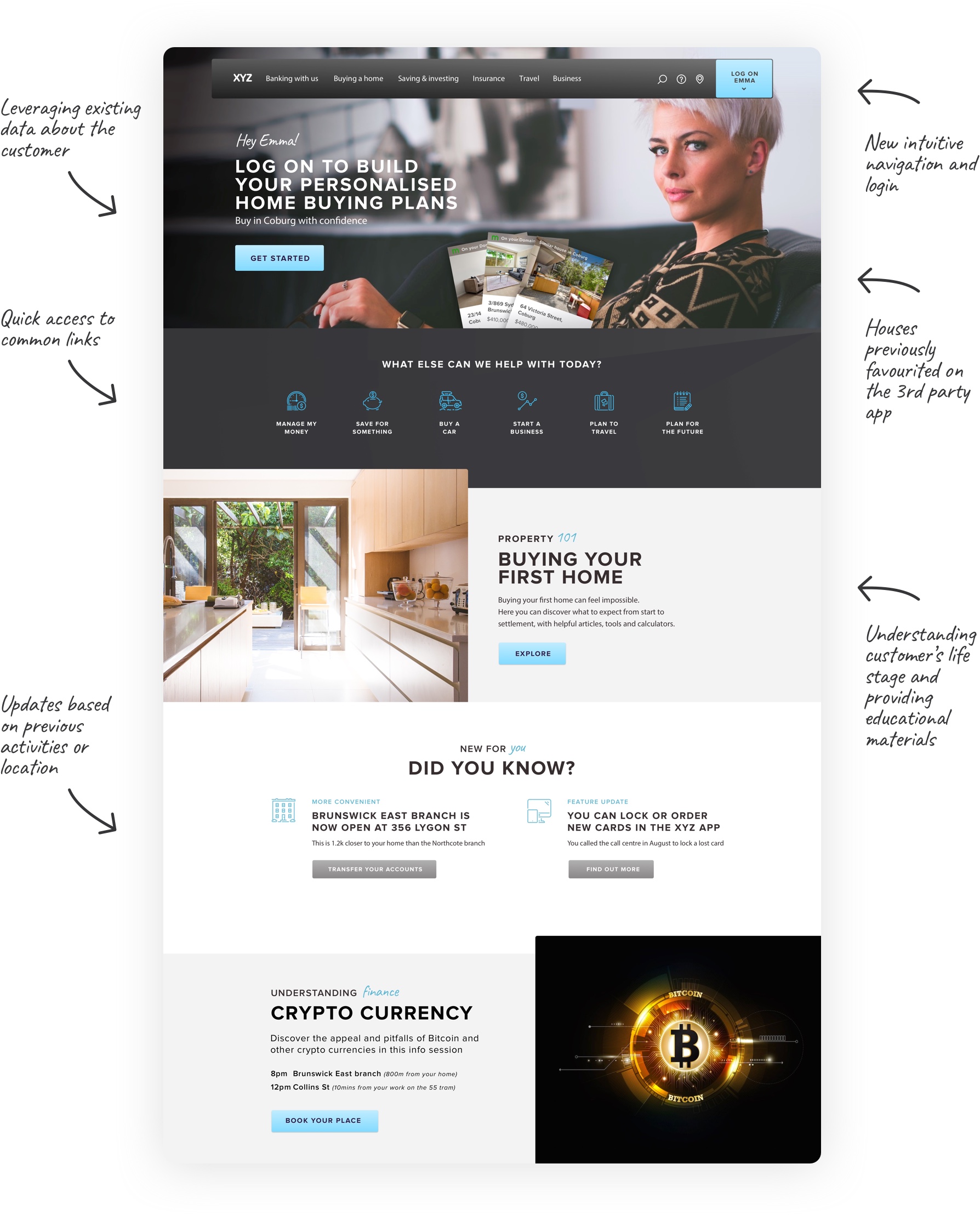

Browsing details will be carried out when the customer lands on the website presenting them with the personalised experience. More intuitive and user-centric homepage and a new navigation are defined based on user goals, not organisation’s structure.

Intuitive homepage.

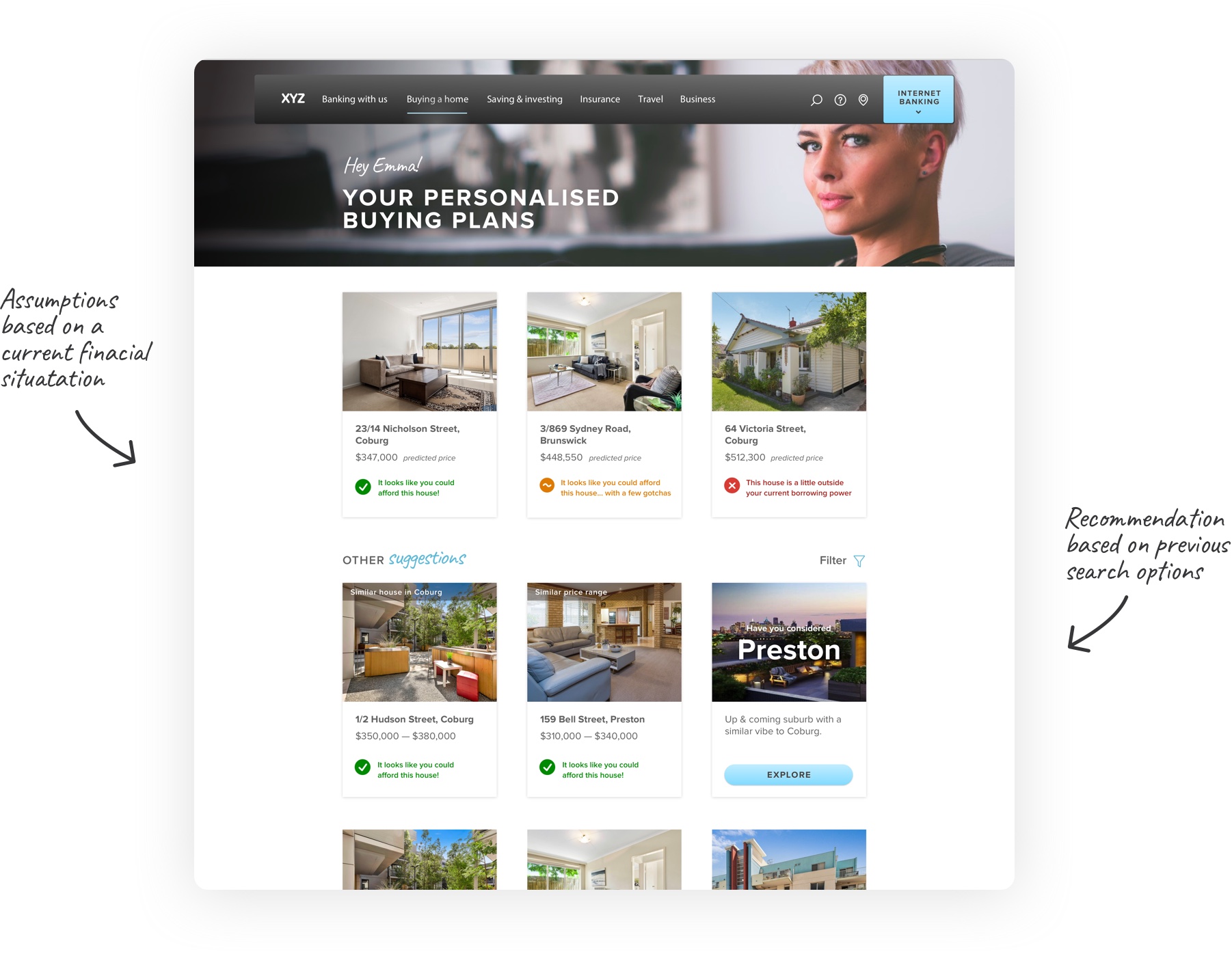

After successful login the customer is presented with personalised buying plan based on their browsing history and relevant suggestions. By efficient use of data we can accurately predict the financial situation and house affordability. All these happen after the authentication process in a way that adds value without being invasive.

Personalised buying plan.

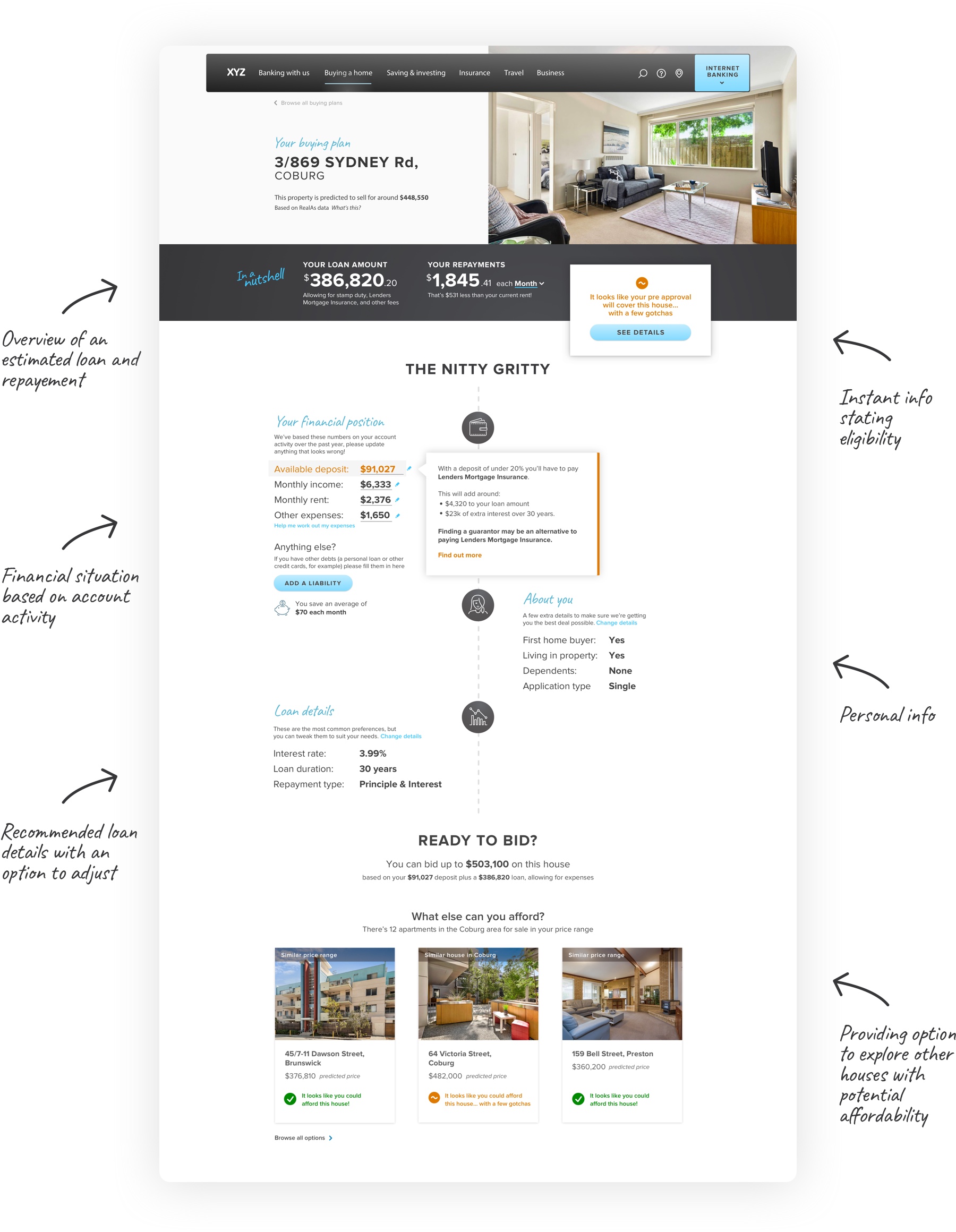

The financial assumptions are based on the knowledge the bank has at the moment. The customer can edit it in order to receive more accurate result. If they can afford the house they can apply for an automatic pre-approval.

Detailed plan showing a scenario when the customer can afford a house, but with a few adjustments.

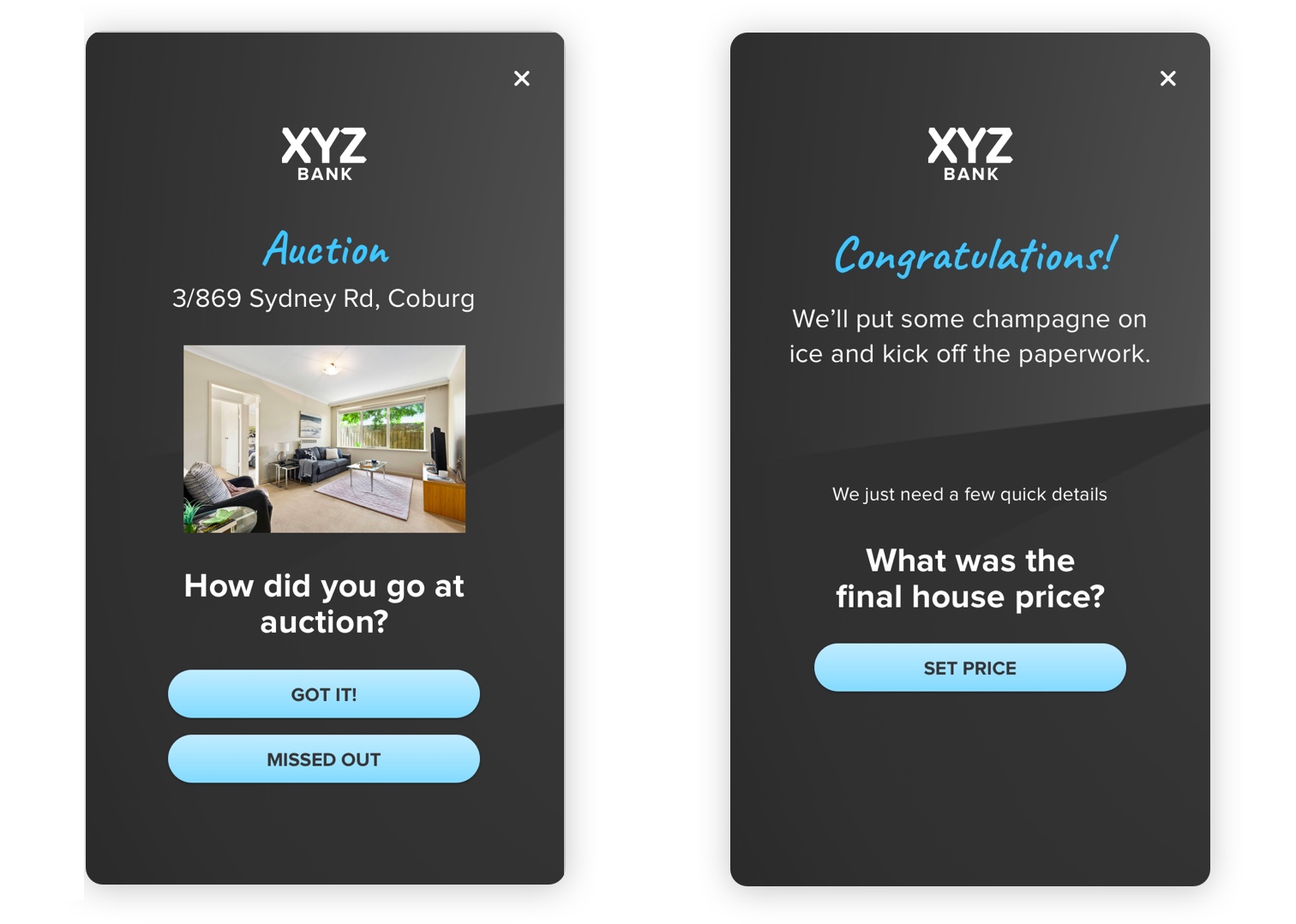

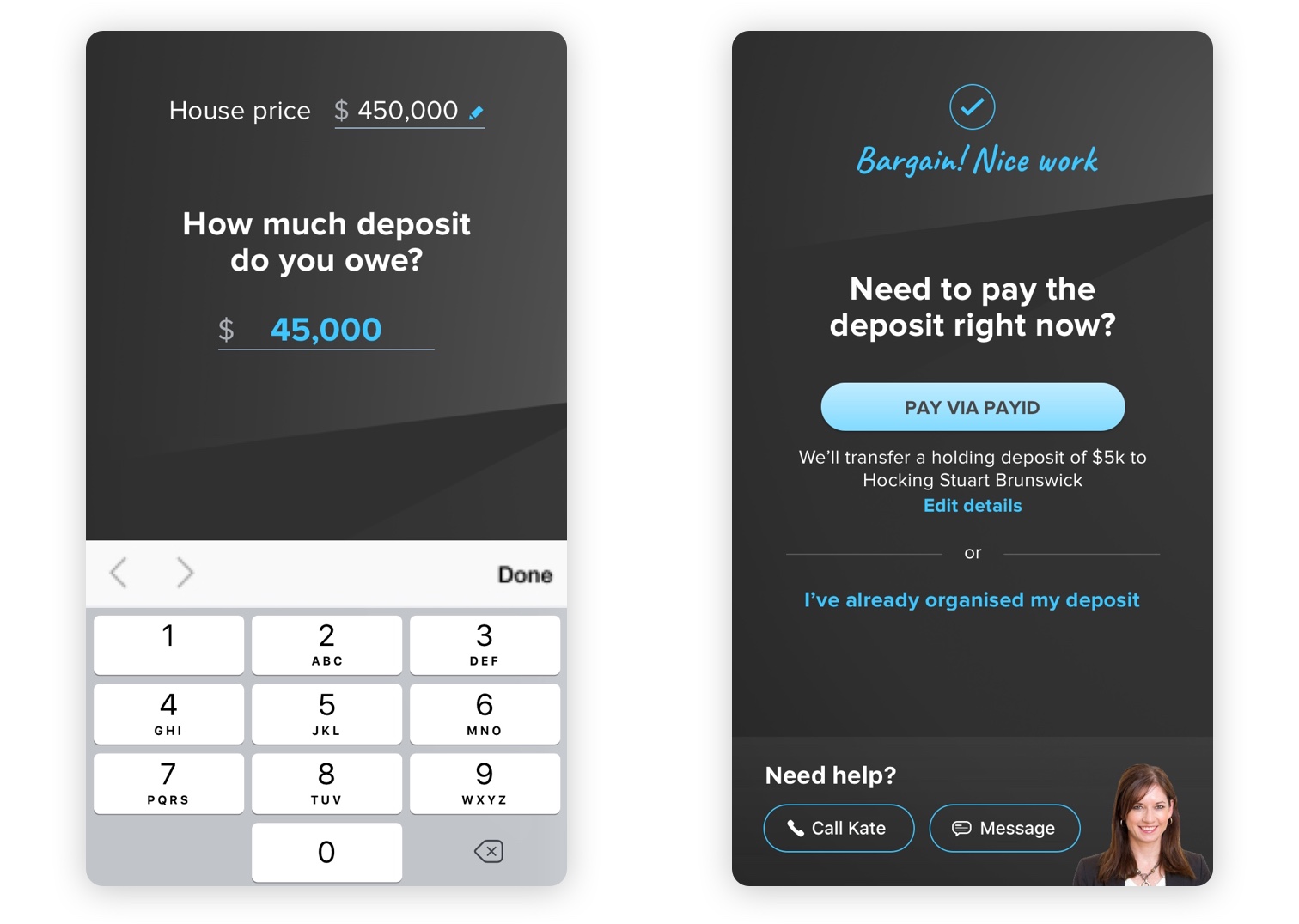

As the objective was to show an end-to-end experience involving different channels, I mapped out how digital can assist before, during and after auction.

Paying deposit via bank’s app.

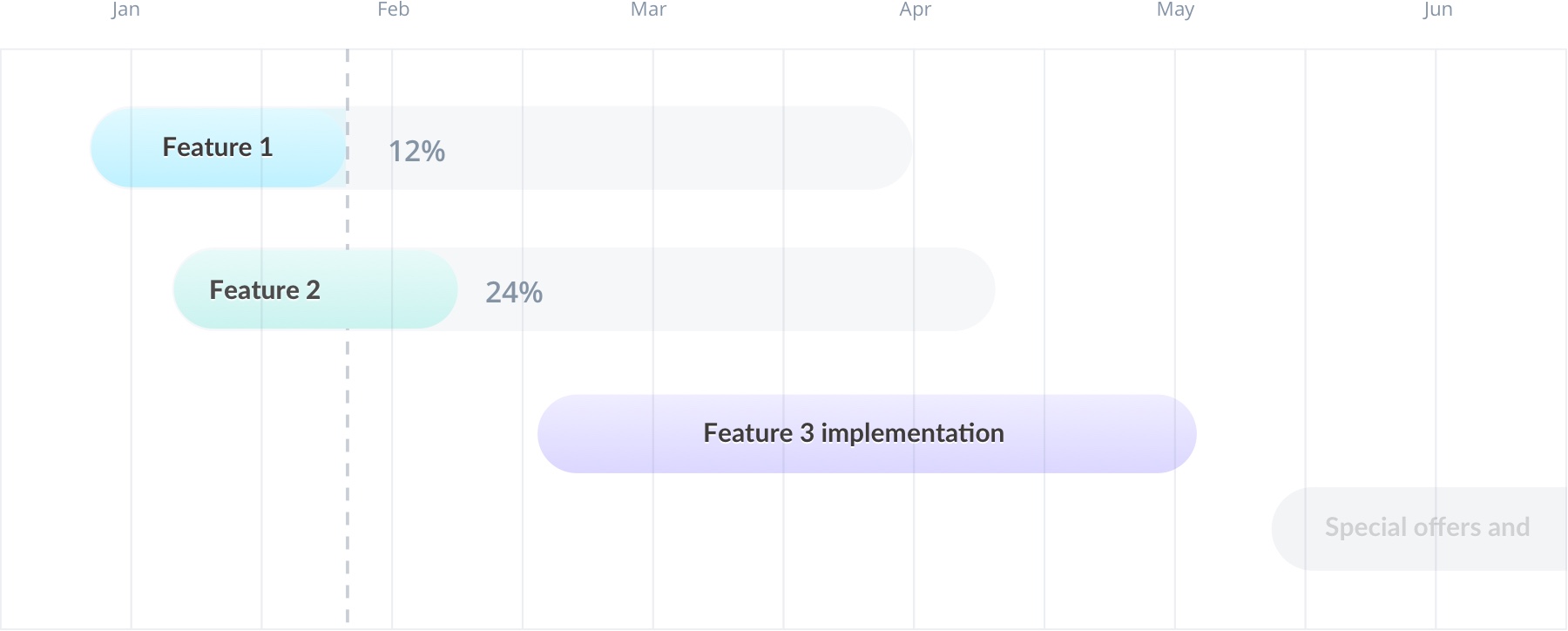

The final section shows the upcoming projects and initiatives and indicate any dependencies that can be resolved after gaining the alignment.

This project was created by Inlight.